Singapore

Here's how APAC property values are faring amidst COVID-19

3 in 5 real estate sectors saw values decline in the first half of 2020.

Here's how APAC property values are faring amidst COVID-19

3 in 5 real estate sectors saw values decline in the first half of 2020.

Singapore records highest monthly condo resale volume in 2 years

An estimated 1,052 condos were resold in August, up 7% from July. According to PropNex, the private condominium resale market is re-invigorated and appeared to have made a full recovery from the slowdown during the circuit breaker. SRX reported that an estimated 1,052 resale condos were transacted in August - an increase of 7% from July and the highest monthly sales volume in two years. The mass market or Outside Central Region (OCR) accounted for nearly 60% of resale transactions in August, fuelled by demand from HDB upgraders and the owner occupiers. Here’s more from Wong Siew Ying, Head of Research and Content, PropNex: We also note that the sales of 1,052 resale private homes in August 2020 also trumped the 1,003 units resold in the entire Q2 2020, according to figures from SRX. The spike in resale volume last month was not unexpected as pent-up demand from the 10-week circuit breaker and phase 1 period continued to come into the market. Given the lacklustre economic outlook and market uncertainty, some buyers may have perceived it to be a good opportunity to negotiate for a better pricing. Based on our observations, Q2 2020 – being the quarter where the circuit breaker and phase 1 period were imposed – was probably the low-point of the resale market. The upturn in sales in recent months likely signalled that the worst is over, paving the way for resale market activities to return to normal. With more than 5,000 resale condos sold in the first 8 months of 2020 based on SRX data, we expect total resale volume to likely reach 7,500 to 8,000 units this year – a tad lower than 8,949 units resold in 2019; but still very a respectable number in view of the massive disruption from the pandemic. Despite the rise in demand, resale condo prices in August remained largely stable, inching up by 0.4% over July. Both the Core Central Region (CCR) and Rest of Central Region (RCR) saw a marginal resale price increase of 0.3% month-on-month (MoM) in August, while in the OCR – which is supported by a larger pool of buyers – witnessed a 0.5% MoM increase in resale prices. We would expect resale prices to be relatively flat in the coming months, as the gloomy economic prospects and muted sentiment weigh on sellers’ ability to raise asking prices substantially. In addition, buyers are likely to be cautious and prudent in their purchase, mindful of potential downside risks ahead, including the weaker hiring market.

How will APAC corporate real estate leaders manage their portfolios post-pandemic?

Nearly 1 in 2 leaders expect to rationalise their portfolio and decrease their total footprint.

Pent-up demand boosts Singapore's HDB resale market with 2,435 flats resold in August

Data released by the SRX showed that the HDB Resale market continued to gain ground with brisk sales and firmer prices in August.

Singapore residential lettings down 18.4% to 19,506 in Q2

Island-wide rents were also down 1.2% QoQ, led by the landed segment.

APAC office investment sales down 48% to USD21.6b in H1

But volumes rose 17% QoQ due to a pick-up in Shanghai, Beijing and Singapore.

1 in 2 investors expect APAC real estate investment to recover in H1 2021

Japan, Australia, South Korea, and China likely to see more transactional activity into 2021.

Office rents in Hong Kong, Sydney, Jakarta, Manila to decline by over 10% by end-2020

Weighted average APAC rents should fall 5% over 2020.

New office supply in APAC up 12% YoY in Q2, driven by India and Melbourne CBD

Aggregate new supply in the 19 APAC cities that Colliers tracks closely reached about 1.42 million square metres in Q2 2020.

Singapore sees significant demand for larger flats in mature estates

Competition is tough for units in Ang Mo Kio and Geylang.

Rents for Singapore's high-spec industrial spaces decline for the first time in three years

Average monthly rent was down by 0.3% QoQ to S$3.48 per sq ft.

Office space absorption in APAC to drop 41% over 2020

Absorption fell 56% QoQ to 0.48 million square metres in Q2.

APAC retail sector poised for sluggish recovery post-COVID

Retail rents are expected to fall sharply in major cities in APAC.

Singapore strata office unit sales drop to a measly 79 in H1 2020

This translates to a total transacted value of S$272.2m, down 42.3% from S$471.4m in H2 2019.

APAC office sector's net absorption hits decade-low in H1

It fell 34% to 16.3 million sq ft, no thanks to tenants cutting costs amidst the pandemic.

APAC logistics rents to rise by around 3% this year

Strong warehouse demand from e-commerce platforms is driving robust leasing activity in APAC.

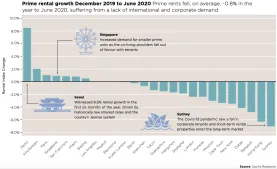

Sydney rents worst hit by COVID, whilst Seoul and Moscow prices rose most: Savills

The Savills Prime Index: World Cities report shows just how much has changed in property since COVID hit.

Advertise

Advertise